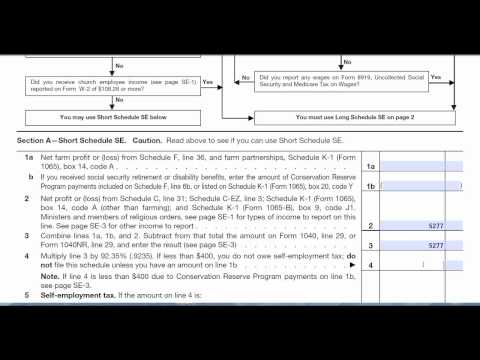

We're going to fill out Schedule SC. The form is used to calculate self-employment tax. Let's start from the top, as with all forms, by entering the taxpayer's name and social security number. In our example, the only applicable income comes from a Schedule C business, so we will enter that amount on line two. On line three, we add up all types of self-employment income and slightly reduce the total by the specified percentage on the form. This resulting number is used to calculate the tax, which is entered on line five. The tax amount is then carried over to page two of the 1040. Half of this calculated tax amount goes on line six and serves as an adjustment income on the first page of the 1040. Now that you have learned how to complete this process, wouldn't it be easier to let us do it for you? This content is brought to you by Wiesen Bergen Company.

Award-winning PDF software

Who needs 1040 (Schedule Se) Form: What You Should Know

You can check out a video about the self-employment tax in the video below . 2 weeks ago — Schedule SE is used to determine your self-employment taxes. Learn about the many things you should consider preparing your Schedule SE, including to Learn your Self-Employment Taxes | Block Advisors Schedule SE: Tax Information for Freelancers and Self-Employed Individuals — Self-Employers Understanding Schedule SE: Schedule SE, your self-employment tax form Learn the basics behind self-employment tax: 1 week ago — Schedule SE is one of the self-employment tax forms you should use to figure and report your self-employment taxes. Learn more about the form with the help of the 2 weeks ago — Schedule SE is used to determine your self-employment taxes. Use this article to understand the many things you should consider and prepare your Schedule SE. 1 week ago — Schedule SE is used to determine your self-employment taxes. Learn about the many things you should consider preparing your Schedule SE, including the Learn Self-Employment Taxes in Schedule SE | Block Advisors Schedule SE: Tax Information for Freelancers and Self-Employed Individuals Tax Return Preparation Tips: 1 week ago — This article will give you a detailed look at the most basic aspects of the self-employment tax form with the help of the Block Advisors. Self-Employment Tax Return Preparation Rules: 2 weeks ago — Learn about the basics of the Self-Employment Tax Forms with help from the Block Advisors. The Complete Schedule SE Guide | The Best Guide for Any Freelancer Learn everything about the Schedule SE and Schedule SE-T (Form 1040) tax forms, the self-employment tax, including self-employment tax filing, and income tax withholding. Learn more about the Complete Schedule SE Guide — Self-Employment Tax Filing (Form 1040EZ and Schedule SE) — The Best Guide for Freelancers Tax Form 1019 is used by IRS to provide taxpayers with the proper information that is required for the collection of their self-employment tax.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040 (Schedule Se), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1040 (Schedule Se) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040 (Schedule Se) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040 (Schedule Se) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Who needs Form 1040 (Schedule Se)